Cosmetic Products Store Excel Financial Model Template

Original price was: $300.$100Current price is: $100.

The Cosmetic Products Store Excel Financial Model is a dynamic and flexible tool that provides detailed insights into your cash flow, income statement, balance sheet, and cash flow statement for 60 months. It includes key performance KPIs and valuation charts to help with decision-making. This model guides you in calculating start-up costs and creating a five-year financial forecast, while also helping you understand customer traffic growth and shopping patterns.

Frequently Bought Together

- Description

- Reviews (8)

Description

Introduction

Starting a cosmetics store requires careful financial planning to ensure sustainability and profitability. A well-structured financial model acts as an essential tool for business owners to project revenue streams, estimate operating costs, and analyze financial performance. This Cosmetic Products Excel-based financial model provides a structured approach to evaluating a beauty products business, covering everything from startup costs to financial forecasts.

This document outlines the key elements of the financial model, offering insights into budgeting, financial health, and informed decision-making for entrepreneurs in the cosmetics industry.

Key Components

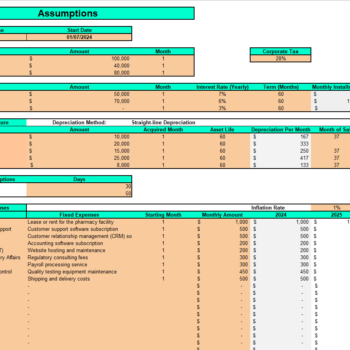

Input Sheet

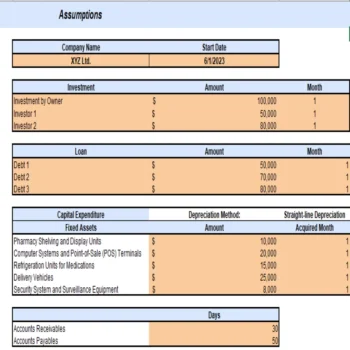

The Input Sheet containing all the key assumptions and variables that drive projections. It also serves as the foundation of the Cosmetic Products financial model, containing all the key assumptions and variables that drive projections. Key components include:

- Startup Costs: Initial investment, equipment, and setup expenses.

- Operational Costs: Rent, utilities, payroll, and marketing expenses.

- Market Trends: Demand forecasts, customer demographics, and pricing strategies.

- Direct Costs: Procurement, supplier agreements, and shipping expenses.

- Sales Forecast: Expected monthly and annual revenue based on market demand.

Revenue Analysis

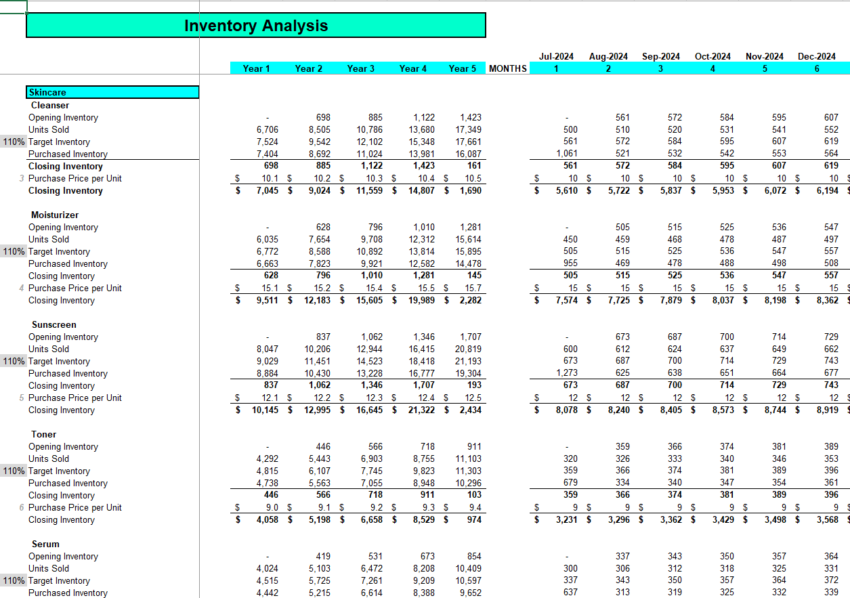

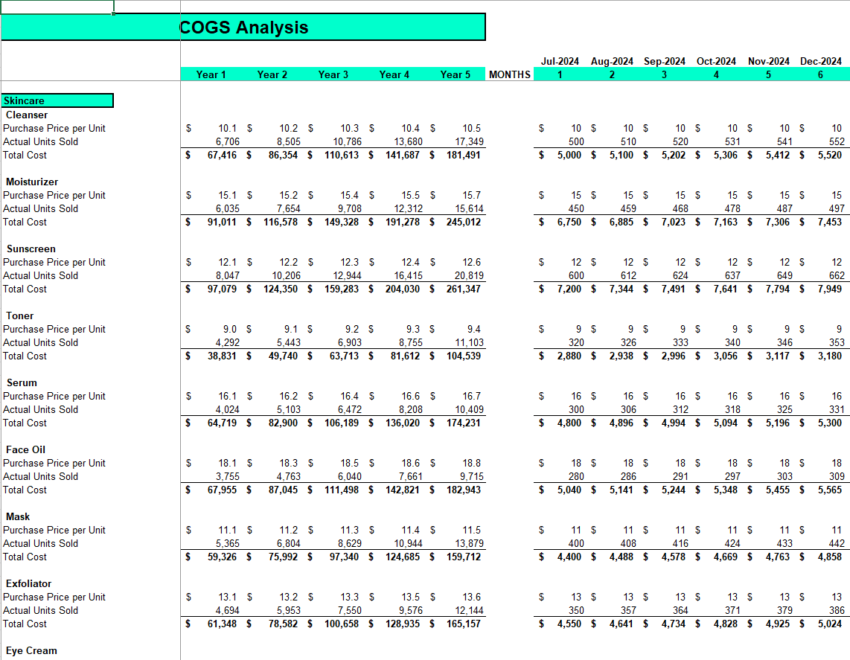

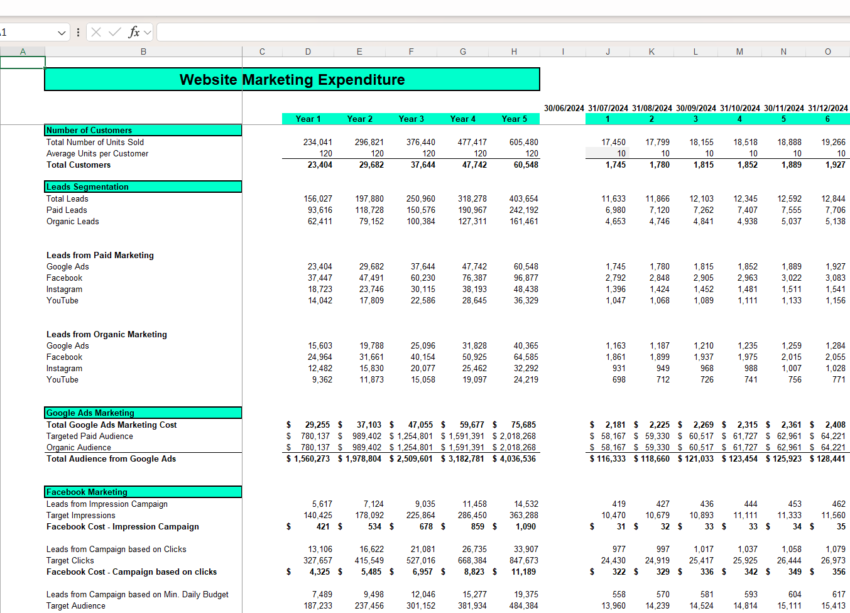

A detailed Revenue Analysis helps business owners understand potential revenue streams of the cosmetic products financial model:

- Retail Sales: Income from in-store and online sales of skincare products and beauty products.

- Subscription Models: Recurring revenue from beauty box memberships.

- Wholesale: B2B sales to salons, spas, and retailers.

- Seasonal Trends: Analysis of peak and slow seasons.

- Market Demand: Impact of product launches and promotional strategies on revenue.

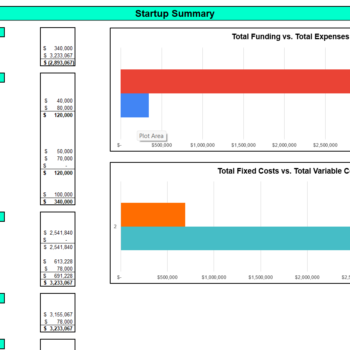

Startup Summary

The Startup Summary outlines:

- Initial Investment: Breakdown of funding requirements.

- Fixed Assets: Purchase of equipment, fixtures, and store setup.

- Working Capital Needs: Required funds for initial inventory and operational expenses.

- Funding Options: Sources such as personal savings, bank loans, and investor funding.

- Break-even Points: Expected time frame to achieve financial stability.

Depreciation and Amortization Schedule

Depreciation and amortization impact financial performance:

- Fixed Asset Depreciation: Wear and tear on store equipment.

- Amortization of Intangible Assets: Brand value, trademarks, and licenses.

- Impact on Profit Margins: Allocation of costs over asset lifespan.

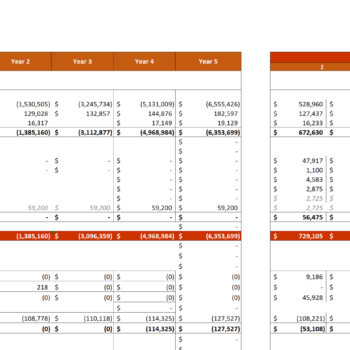

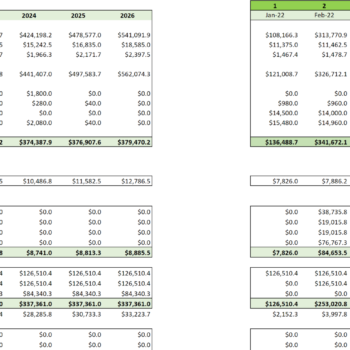

Income Statement

The Income Statement (Profit and Loss Statement) tracks financial performance:

- Revenue Projections: Forecasting revenue from different sales channels.

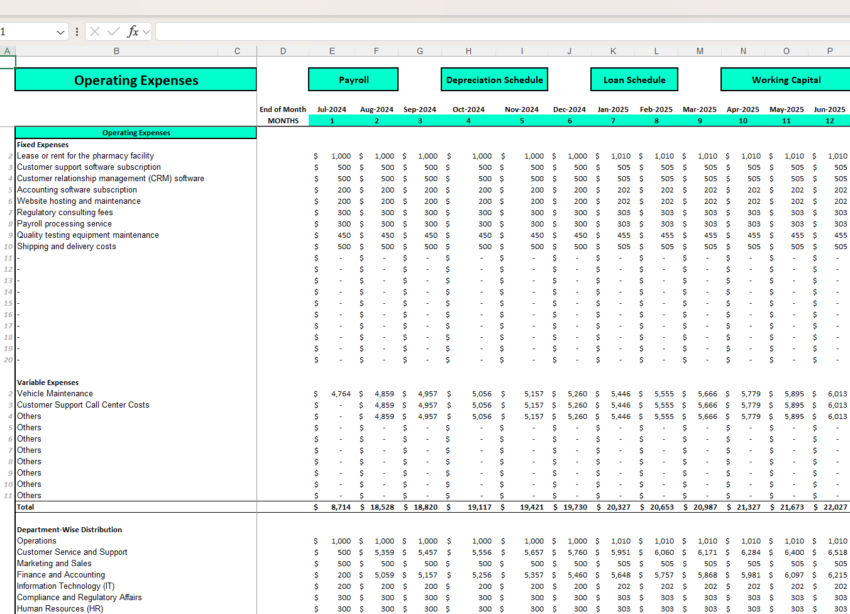

- Operating Expenses: Expenses involved in operating the business.

- Profit Margins: Gross and net profit analysis.

- Cash Burn Rate: Monthly operational costs versus revenue inflows.

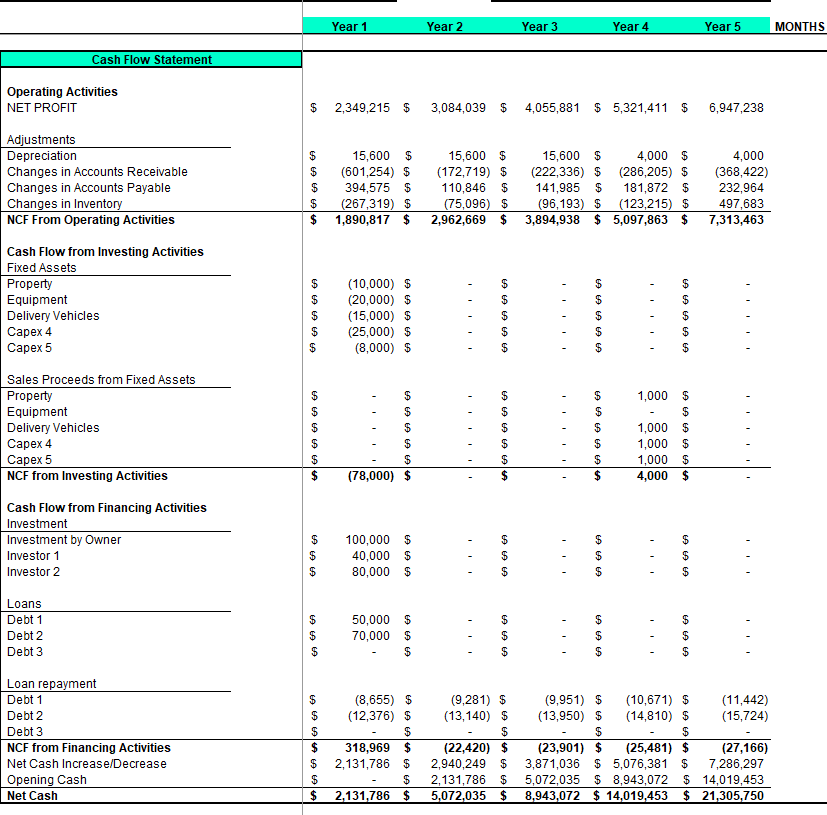

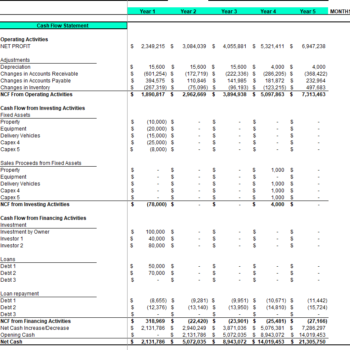

Cash Flow Statement

The Cash Flow Statement tracks inflows and outflows:

- Operating Cash Flow: Daily business operations.

- Investing Cash Flow: Purchase of assets and equipment.

- Financing Cash Flow: Loans, investor funding, and repayments.

- Cash Balance Management: Ensuring liquidity for operational stability.

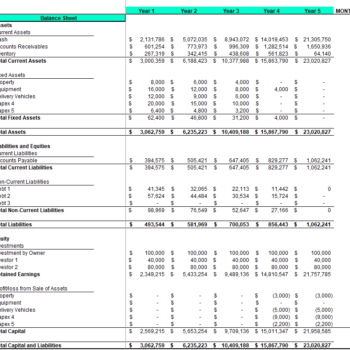

Balance Sheet

The Balance Sheet represents the financial position:

- Current Assets: Inventory, accounts receivable, and cash.

- Fixed Assets: Property, equipment, and intangible assets.

- Liabilities: Loans, accounts payable, and operational expenses.

- Equity: Owner’s investment and retained earnings.

Breakeven Analysis

The Breakeven Analysis determines:

- Level of Sales Needed: The point at which revenue covers expenses.

- Fixed and Variable Costs: Relationship between cost structure and profitability.

- Impact of Pricing Strategy: How pricing affects market positioning and profitability

Project Evaluation

A thorough Project Evaluation assesses:

- Financial Viability: Returns on initial investment.

- Revenue Growth Projections: Future revenue scaling.

- Market Conditions: Competitor analysis and pricing trends.

- Risk Analysis: Business scenarios affecting financial stability.

Sensitivity Analysis

Sensitivity Analysis evaluates financial outcomes under different business scenarios:

- Market Fluctuations: Impact of supply chain and customer behavior changes.

- Operating Costs Variations: Effects of rent, wages, and advertising costs.

- Financial Forecasting Adjustments: Adapting to economic shifts.

KPIs and Financial Ratios

Key Metrics used to measure performance:

- Financial Ratios: Profitability, liquidity, and leverage ratios.

- Cost of Sales: Direct and indirect costs affecting margins.

- Operational Costs: Budget planning for sustainable growth.

- Marketing Costs: Return on investment in advertising campaigns.

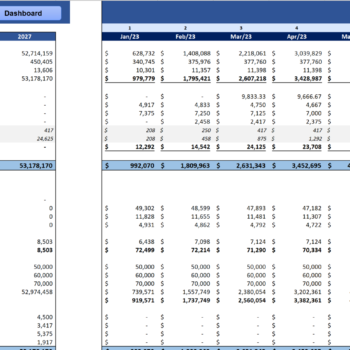

Dashboard

This Financial Dashboard offers:

- Visual Financial Reports: Print-ready reports for stakeholders.

- Budgeting Tools: Aiding in financial planning decisions.

- Statement of Cash Flows: Summarized cash movement overview.

- Forecasting Reports: Ready-to-use financial forecast templates.

Conclusion

This Financial Model is an essential tool for financial planning, investment analysis, and operational decision-making. It provides beauty industry entrepreneurs with a structured approach to budgeting, forecasting revenue, and achieving financial stability in the competitive cosmetics industry.

FAQ’S

Who is this financial model designed for?

It’s for entrepreneurs, financial advisors, and cosmetics shop owners planning or running a beauty products business.

What financial statements are included in this model?

The Excel model includes all standard financial statements:

- Income Statement (Profit and Loss Statement)

- Cash Flow Statement

- Balance Sheet Forecast

These reports help you monitor profit margins, assess your financial position, and track your cash balance over time.

How can this model help me secure funding?

The model provides a clear overview of your funding requirements, initial investment, and projected financial performance. With accurate cash flow projection and financial ratios, it allows you to present credible financial reports to banks, investors, or other funding sources, enhancing your chances of secure funding.

Can I customize this model for my business?

Yes. This is a forecast-ready, fully editable Excel spreadsheet. You can update assumptions, modify operating expenses, adjust revenue projections, and test different business scenarios using the built-in sensitivity analysis. It’s designed to fit various cosmetics business models, including retail, e-commerce, and B2B.

Does the model account for seasonal trends and market fluctuations?

Absolutely. The model includes inputs for market trends, seasonal demand, and pricing strategies, allowing you to adapt your financial strategy to different market conditions. The sensitivity analysis module also helps you evaluate the impact of these factors on your financial outcomes and financial stability.

Terms of Use

Oak Business Consultant’s financial model templates are not officially affiliated with any specific software or platform unless stated. Your purchase grants a single license for personal or business use—redistribution, resale, or sharing is strictly prohibited. If you wish to recommend our product, please direct others to our shop.

Note

As this is a digital Excel file, returns or exchanges are not available. Please ask any questions before purchasing—we’re happy to assist!

Walk-Through Video of Cosmetic Products Store Excel Financial Model Template

The following video will give you an overview of the different components of the financial model and will help you understand how it works.

8 reviews for Cosmetic Products Store Excel Financial Model Template

Add a review

You must be logged in to post a review.

Isebella Kim –

Highly customizable and detailed, This model helped us forecast sales for each product category and track our profit margins with precision

Milli kim –

A very handy and complete financial model,highly recomended

Sophie Laure –

This model is a must-have for any beauty brand. It’s helped us track profits, plan our budget, and manage expenses efficiently. Very pleased with the results

Alure Len –

We used this model to forecast profits for our new cosmetic line. The reports are detailed, accurate, and investor-ready. It has been an excellent tool for growth planning

Mason Camp –

The cash flow forecasting tools are excellent. It’s easy to use and customize, making it a valuable resource for any cosmetic startup or established brand.

Kette Colen –

With this model, we’ve been able to optimize pricing and forecast future sales with precision.

Mertin Ellon –

This financial model has been a game changer for our cosmetics business. It offers accurate revenue forecasts and helps us manage production costs eff.iciently. Highly recommended

David –

Handy and adjustable model